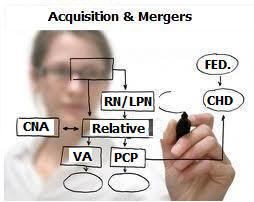

Medical and Home Care Business Acquisitions and Marketing

Business

Marketing Services

We

have the resources, and experience to establish the ďmarket

valueĒ of each principalís ownership interest in business assets

and lease rights in their home care business.

The financial and

economic dynamics of a home healthcare firm are very different from

those factors which impact the value of a manufacturing company. The

market value for each home care business depends upon whether it is

home RN/LPN, relative care, companion care, PCP/CNA or adult daycare

service, the franchise concept and other factors. The value

of a home care business is also impacted by the structure of the

equipment and facility lease agreements. Acquiring an ongoing home

care business usually presents the challenge of State and Federal

transfer approval in addition to the business buyout.

Business valuation methods

fall into 13 major categories, depending on where the major focus

of the analysis is centered. The corporate financials statements of

small home care businesses must be

Normalized (recast) to arrive at a "market

value." The "business

life cycle" of the home care agency, industry, and/or market segment

are factors which impact the market value and

business

selling process of an ongoing home care business

concern. We

have the resources, and experience to establish the ďmarket

valueĒ of each principalís ownership interest in business assets

and lease rights in their home care business.

The financial and

economic dynamics of a home healthcare firm are very different from

those factors which impact the value of a manufacturing company. The

market value for each home care business depends upon whether it is

home RN/LPN, relative care, companion care, PCP/CNA or adult daycare

service, the franchise concept and other factors. The value

of a home care business is also impacted by the structure of the

equipment and facility lease agreements. Acquiring an ongoing home

care business usually presents the challenge of State and Federal

transfer approval in addition to the business buyout.

Business valuation methods

fall into 13 major categories, depending on where the major focus

of the analysis is centered. The corporate financials statements of

small home care businesses must be

Normalized (recast) to arrive at a "market

value." The "business

life cycle" of the home care agency, industry, and/or market segment

are factors which impact the market value and

business

selling process of an ongoing home care business

concern.

Business Acquisition Services

RMD is a fulltime professional home

care business intermediary organization engaged in the marketing of

ongoing businesses. Each RMD business intermediary combines his or

her

experience with the cumulative knowledge of RMD and applies this

knowledge to service your unique home care acquisition needs. The

home care clients of each home care agency have "absolute final

control" over which home care agency will provide service to them.

Hence, when one acquires a home care agency the agency's "clients"

are never sold as part of the business acquisition transaction.

When an entrepreneur acquires a home care business he/she buys much

more than the intellectual property, furniture and fixtures. They

buy a new lifestyle and opportunity to expand into new markets. A

minority or women owned business might have a high value because of

local, State or Federal contracts. A business which is designated a

Disadvantage Business Enterprise (dbe), SBA 8 (a), or VA firm has

unique elements of value compared to a non-designated company. The

corporate financial statements of most small businesses must be

re-cast to arrive at a "market

value." We realize that finding

and buying the right home care business isnít easy and may be one of

the most important decisions in your life. Our most important goal

is for each transaction to satisfy the needs and goals of our buyer. her

experience with the cumulative knowledge of RMD and applies this

knowledge to service your unique home care acquisition needs. The

home care clients of each home care agency have "absolute final

control" over which home care agency will provide service to them.

Hence, when one acquires a home care agency the agency's "clients"

are never sold as part of the business acquisition transaction.

When an entrepreneur acquires a home care business he/she buys much

more than the intellectual property, furniture and fixtures. They

buy a new lifestyle and opportunity to expand into new markets. A

minority or women owned business might have a high value because of

local, State or Federal contracts. A business which is designated a

Disadvantage Business Enterprise (dbe), SBA 8 (a), or VA firm has

unique elements of value compared to a non-designated company. The

corporate financial statements of most small businesses must be

re-cast to arrive at a "market

value." We realize that finding

and buying the right home care business isnít easy and may be one of

the most important decisions in your life. Our most important goal

is for each transaction to satisfy the needs and goals of our buyer.

RMD's website is intended to answer

many of your questions and help you understand the critical steps in

the

acquisition process on the business being acquired. Our

advisors manage the acquisition process by:

1.

Determining whether the transaction should be an "asset or stock

purchase;"

2.

Completing a due diligence on the business;

3.

Conducting an industry "business cycle analysis;"

4.

Re-cast the corporate and personal financial statements;

5.

Providing an analysis of the corporate and personal tax

documents;

6.

Creating Professional business profiles;

7.

Providing a valuation (appraisal) of the business;

8.

Generating an "acquisition pro-for ma financial;" and

9.

Assisting with financing.

We have sold and acquired businesses in

the following venues and industries:

-

Accounting and bookkeeping firms;

-

Airport Concessions (Food and Retail and Services);

-

Automotive Repair and sales;

-

College and University Venues (Food and Retail and

Services);

-

Construction & Manufacturing;

-

Consumer Products;

-

Food and Retail and Services industries;

-

Home Healthcare;

-

Metro-Transportation Centers (Food and Retail and Services);

-

Professional Sports Venues (Food and Retail and Services);

-

Retail and Wholesale;

-

Shopping Mall (Food and Retail and Services);

-

Technology

-

Telecommunications; and

-

Transportation services and centers;

-

Warehousing Company.

A review of our

sample engagement agreement will

provide details about the scope of services offered.

|